Third-Party Risk Management - A Comprehensive Guide 101

Join thousands of professionals and get the latest insight on Compliance & Cybersecurity.

In today’s rapidly changing business environment, success is often a matter of who you know – or in many cases, who you work with. Third-party relationships can be a boon, opening doors and enabling innovation. However, they can also be a complex web, a vast network that can introduce a host of risks, especially cybersecurity risks.

Understanding the gravity of these risks is crucial.The vulnerability of third-party connections presents a formidable challenge for organizations navigating the cybersecurity landscape.This underscores the critical importance of implementing a proactive and strategic Third-Party Risk Management (TPRM).

This TPRM blogpost will help demystify TPRM, explain why it’s important, and provide best practices to fortify your organization against these risks.

What is TPRM?

Third-party risk management (TPRM) is a proactive and strategic approach to identifying and mitigating the varied risks associated with an enterprise’s use of third parties (also known as vendors, suppliers, partners, contractors, or service providers) for its business requirements

TPRM helps organizations understand the third parties they work with, how they are used, and what safeguards the third parties have in place. The scope and requirements of TPRM vary from one organization to another based on industry, regulations, and other factors, but many best practices are universal. TPRM can be thought of as a broader discipline that includes vendor risk management (VRM), supplier risk management, and supply chain risk management. By implementing a robust TPRM program, organizations can reduce the likelihood of disruptions to their operations and protect their reputation, data, and assets.

Importance of TPRM in 2024

In 2024, Third-Party Risk Management (TPRM) continues to be critical for organizations across various industries due to the evolving threat landscape, increasing reliance on third-party vendors, and rising regulatory scrutiny. According to Deloitte, last year 62% of global leaders identified cyber information and security risk to be the top third-party risk. At the same time, almost half (42%) of them believe that their third parties play a more important role than ever in driving revenue compared to three years ago. This highlights the significant challenges and responsibilities faced by third-party risk management and security teams in identifying, managing, and mitigating the varied risks associated with integrating them into their IT environment.

Increased regulatory scrutiny:

The increasing focus on data protection and privacy regulations like GDPR, MAS TRM, and CCPA has led to a greater scrutiny of third-party outsourcing. Regulators worldover, like those in the EU and the US, are demanding tighter governance and accountability, particularly in AI and cloud services. Rules like DORA, NYDFS, and NIS2 mandate mapping third-party assets, evaluating criticality, and adopting proactive risk management strategies, including third-party risk assessments. This shift requires organizations to ensure TPRM practices align with evolving regulations.

Evolving threat landscape:

With businesses increasingly leveraging cloud services, the potential attack surface has grown. TPRM is crucial in identifying and mitigating these emerging risks by implementing and monitoring effective cybersecurity measures. However, enterprises must consider the shared responsibility model of cloud infrastructure systems like AWS, which shifts certain responsibilities to SaaS providers. This shift complicates data security and can lead to vulnerabilities, as seen in the 2015 Uber breach. Companies must implement best practices and maintain strong oversight of their cloud services and third-party relationships.

Examples of Third-Party Risks

Organizations face various third-party security risks, some of which are mentioned below:

Cybersecurity Risk: The association with third parties can result in many kinds of cyber threats, including data breaches or even data loss. Routine evaluation of vendors and tracking of their activities is one of the measures aimed at minimizing this risk.

Operational Risk: Third-party initiatives and disruptions can prevent business operations from going normal. To eliminate this, companies usually implement SLAs (service level agreements) with vendors and prepare backup plans for the sustenance of business continuity.

Compliance Risk: Third-party activities can increase an organization’s risk of noncompliance with established standards or contractual agreements. This area is particularly sensitive for companies that operate in industries with a high degree of regulation, such as banking, telecom, government, and the health sector.

Reputational Risk: Any organization working with third parties faces potential reputational risks from adverse incidents. Such incidents involve security failures, data breaches, or unethical behavior. They can damage customer trust loss, brand reputation, and overall business quality.

Financial Risk: Inadequate management of third-party relationships can also cause financial difficulties for companies. A third party with inadequate security measures may attract fines and legal fees, further damaging the company’s financial stability.

Strategic Risk: Furthermore, third-party risks can be detrimental to an organization’s strategic objectives. If not addressed adequately, they can impede business success.

These risks often converge – for example, a breach can lead to loss of customer data, posing simultaneous risks to operations, brand reputation, finances, and compliance

Third-Party Risk Management Lifecycle

1. Recognition and Categorization of Third-Party Risk

Effective third-party risk management starts with understanding and categorizing the risks posed by different third-party relationships. This involves creating a complete inventory of all vendors, suppliers, contractors, partners, and other third-party entities that an organization engages with. Here are several factors to consider when categorizing these relationships:

- Determine access level: Providers with high levels of access to sensitive data or systems are the ones considered to be at high risk.

- Relationship type: Providers that take a rather meaningful part in the enterprise are thought of as higher-risk ones.

- Industry or sector: Particular industries or sectors could be more prone to risks, such as fraud or data breaches.

- Regulatory compliance: Ensure clarity and alignment with regulatory expectations by categorizing third-party risks according to specific compliance mandates and industry regulations.

- Financial stability: The providers with financial instability are likely to raise the risk levels of organizations.

Categorizing third-party relationships based on these factors can help organizations prioritize their risk management efforts and allocate resources more effectively to mitigate potential risks. It also provides a framework for ongoing monitoring and assessment of these relationships.

2. Risk assessment and Due Diligence

In the second stage of the TPRM lifecycle, organizations conduct a comprehensive risk assessment and due diligence to ensure the reliability and compliance of their third-party relationships with their security requirements.

Risk assessment involves:

- Identifying the third-party risk associated with each outsourced relationship

- Measuring the probability and potential impact of these risks, which may involve financial stability, operational resilience, regulatory compliance, and safe use of data.

Due diligence involves:

- Assessing the provided information by the third parties for reliability and capabilities of the provider, which may include reviewing the financial data and documents, among others.

- Creating policies and procedures for when outside parties are involved, such as making sure external agents are obligated to follow the security standards and provisions of the company, including data encryption and access controls.

This step of the TPRM lifecycle should be aimed at ensuring that the organization fully understands the risks that the third-party relationships will bring and acts in response to them, mitigating each to a possible minimum. It also serves as a reference for the constant monitoring and testing of the ties to guarantee that the actions are compliant and secure.

3. Risk Mitigation

After the assessment of risks and fulfillment of due diligence, the next step in the TPRM lifecycle is risk mitigation and management. This means that policies, controls, and processes must be developed to mitigate existing risks in the first stages of third-party risk management and expose the organization to lesser third-party risks.

Risk mitigation and control strategies may include:

- Contractual clauses: Incorporating specific clauses that are meant to outline the duties of each party in the third-party agreement, the privacy, data security, compliance, and indemnification clauses.

- Continuous monitoring: Developing the process of long-term surveillance of third-party actions to ascertain that they comply with the security requirements and conduct regular audits, activities, and periodic reports.

- Data protection: Implementing enforcement measures, which include access restrictions, data encryption, and regular backups.

- Incident response: Ensuring a quick response strategy focused on security incidents including protocols for alerts, incident management, and post-incident assessments.

4. Contracting Management

In the modern business landscape, organizations frequently look to external vendors for a whole host of services – financial services, marketing, and technology, for example. While these relationships can drive substantial benefits, they’re not without risk – risk that must be managed effectively. This is where contractual and relationship management practices come into play.

Establish SLAs: Service level agreements (SLAs) are contracts that set performance benchmarks and service level standards between an organization and a third-party provider. Critical services must have SLAs that include benchmarks for response times, availability, and the timeframe for resolving problems. These metrics should be frequently reviewed and adjusted as required to ensure they meet current business needs and goals.

Manage relationships: It is essential to have a dedicated relationship management team or point of contact to manage third-party partnerships effectively. This team or individual should be responsible for monitoring the third-party provider’s performance, addressing any issues or concerns, and ensuring that the organization’s expectations are being met. Establishing regular channels of communication, status updates, and conducting periodic evaluations are also critical.

Ensure compliance: Third-party providers must comply with all contractual obligations. This requires ongoing monitoring of the provider’s performance and ensuring that all service-level agreements and other contractual requirements are being met. Additionally, regular audits and assessments should be conducted to ensure compliance with relevant laws, regulations, industry standards, and best practices.

Perform regular review: Contracts with third-party providers should be reviewed and updated regularly to ensure they remain relevant and effective. This includes updating SLAs and other performance metrics to account for changes in business requirements or advancements in technology. Moreover, contracts should be reviewed to ensure they comply with all relevant rules and regulations.

5. Incident response and remediation

In the TPRM life cycle, incident response and remediation features are prominent since they are the safety nets for handling unknown cybersecurity risks. Although organizations use several preventive actions, security incidents can still turn up unexpectedly. Rapid acts of decisiveness are very important since they help mitigate the damage and avoid similar problems in the future.

Here are the key steps in handling security incidents:

Establishing incident response plans: All the parties involved should be well familiar with the roles analysis and the existing incident response plan. The plan should be detailed, identifying and addressing each task from start to finish, and should also cover communications with the key stakeholders and analysis of the incident aftermath.

Addressing third-party involvement: If it is a third-party provider that has been involved, steps should be retained to notify the provider and ascertain their part in the incident. This involves investigating the provider’s security policies and determining if they follow the compliance of any legal requirements and industry standards.

Implementing corrective actions: Once the situation is contained the organizations leverage corrective action to prevent similar incidents from happening again in the future. A new security framework may include: enhancing security measures, updating policies and procedures, and providing additional training and guidance to authorities.

Conducting post-event evaluations: It is essential to conduct a holistic review of the outcomes after the incident to identify areas of improvement. In this evaluation, the focus is on reviewing and improving the security measures, enhancing controls, and reinforcing employee education procedures.

Essentially the relationship between incident response and remediation is an integral part of the TPRM cycle as they function as reactive as well as proactive measures to avoid unexpected risks and secure the data and assets. The establishment of proper and effective incident response protocols can help to ensure the management of risks efficiently and maintain the company’s reputation as well as business continuity.

6. Ensuring Compliance

Compliance is an essential part of the Third-Party Risk Management (TPRM) lifecycle. Compliance efforts ensure that all aspects of the TPRM program align with industry standards and provide a framework for continuous monitoring and improvement, helping organizations adapt to changing regulatory landscapes and emerging threats. This stage includes:

- Monitoring and validating third-party compliance with contractual obligations, regulatory requirements, and industry standards.

- Conducting regular audits and assessments to identify any compliance gaps or areas for improvement.

- Implementing corrective actions or strategies to address compliance issues and improve overall compliance posture.

- Providing ongoing training and support to third parties on compliance-related matters.

- Reviewing and updating compliance policies and procedures in response to changes in regulations or industry standards.

- Ensuring that all aspects of the TPRM program, including risk assessments, due diligence, and relationship management, adhere to compliance guidelines.

7. Monitoring of Third-party relationships

While third-party partnerships offer significant benefits, they also come with inherent risks that need to be managed effectively. This is where sound third-party relationship management practices come into play. This includes:

- Establishing clear service level agreements (SLAs) to set performance expectations between an organization and its third-party provider. This includes defining response times, availability, and problem resolution timeframes.

- Assigning a dedicated relationship management team or point of contact is essential for the effective management of third-party partnerships. They are responsible for monitoring the provider’s performance, addressing concerns, and ensuring that expectations are met.

- Conducting regular audits and evaluations of contracts to ensure ongoing compliance with relevant laws and regulations, as well as alignment with organizational goals and standards.

Best Practices of Third-Party Risk Management

Segmentation

- Divide third-party relationships into separate groups based on their risk levels, significance, data access, and regulation status.

- Prioritize dealing with risks based on the profile of each group so as to use resources wisely.

- Conduct ongoing and monitoring of high-risk groups while periodically reviewing low-risk ones.

Continuous Monitoring

- Maintain an updated inventory of all third-party relationships, including vendors, suppliers, and contractors.

- Establish a process for continuous monitoring of third-party relationships to ensure they meet security standards.

- Regularly perform security assessments, audits, and compliance checks to identify and address emerging risks promptly.

Establish Clear Policies and Procedures:

- Develop and enforce clear policies and procedures for managing third-party risks.

- Identify the roles and responsibilities of the individuals who are part of maintaining the vendor relationships.

- Review and refresh permissions when business needs and risks change.

Collaborate with Internal and External Auditors:

- Collaborate with the internal and external auditors to build a strong third-party risk management program.

- Get help and support from auditors and compliance experts to meet the industry standards and regulatory rules.

- Form cross-functional teams of critical stakeholders and auditors from multiple departments to resolve issues and enhance third-party risk management processes.

Leverage automation for TPRM:

- Utilize automation tools to streamline the collection, analysis, and reporting of TPRM data, enabling real-time insights into vendor risk profiles, compliance status, and performance metrics.

- Implement customizable dashboards and automated reporting functionalities to visualize key risk indicators, trends, and compliance gaps, facilitating informed decision-making and strategic planning.

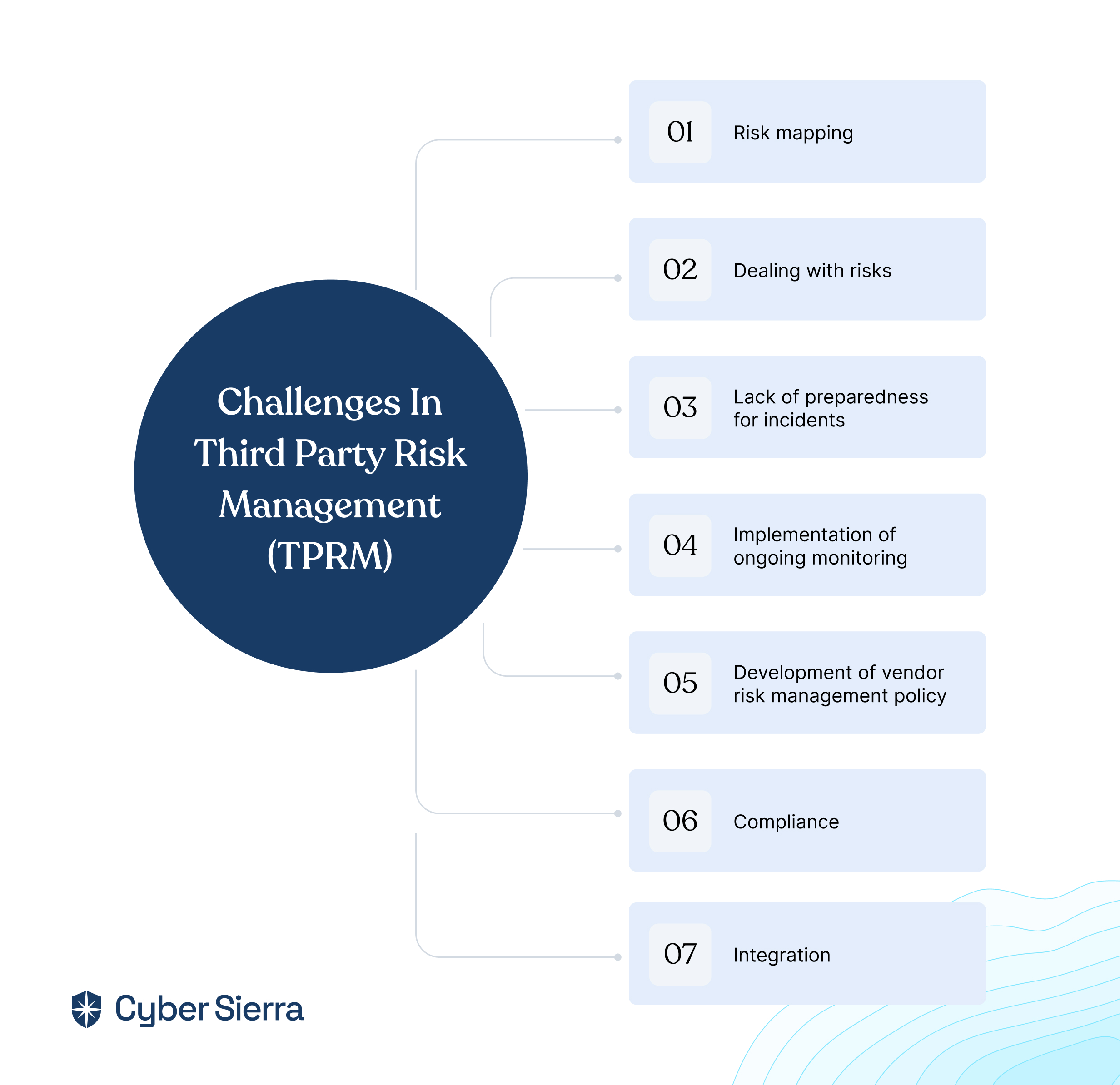

Challenges in Third Party Risk Management (TPRM)

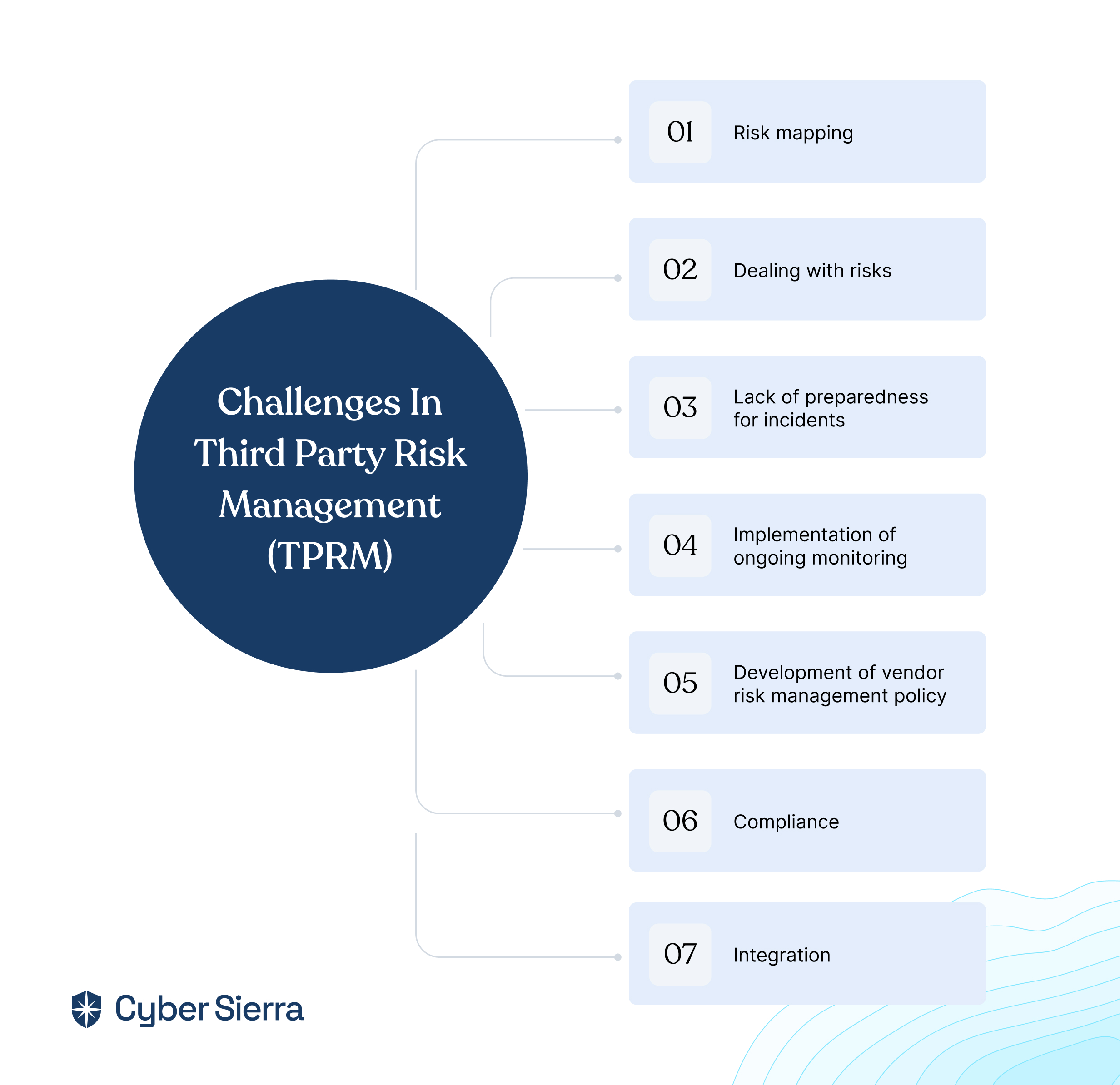

Risk mapping: Organizations face difficulties in developing an overview of their vendor networks. This can result in a lack of visibility into risks and an increase in overall risks.

Dealing with risks: The risk landscape is constantly changing, requiring organizations to be adaptable and proactive in recognizing and handling emerging risks within their third-party partnerships. However many organizations struggle to keep pace with these changes, leaving them susceptible to threats.

Lack of preparedness for incidents: Despite having risk management strategies in place security incidents involving third parties can still occur. To minimize the impact, companies need incident response plans. Nevertheless, many organizations are not adequately prepared to respond effectively to incidents and lack readiness.

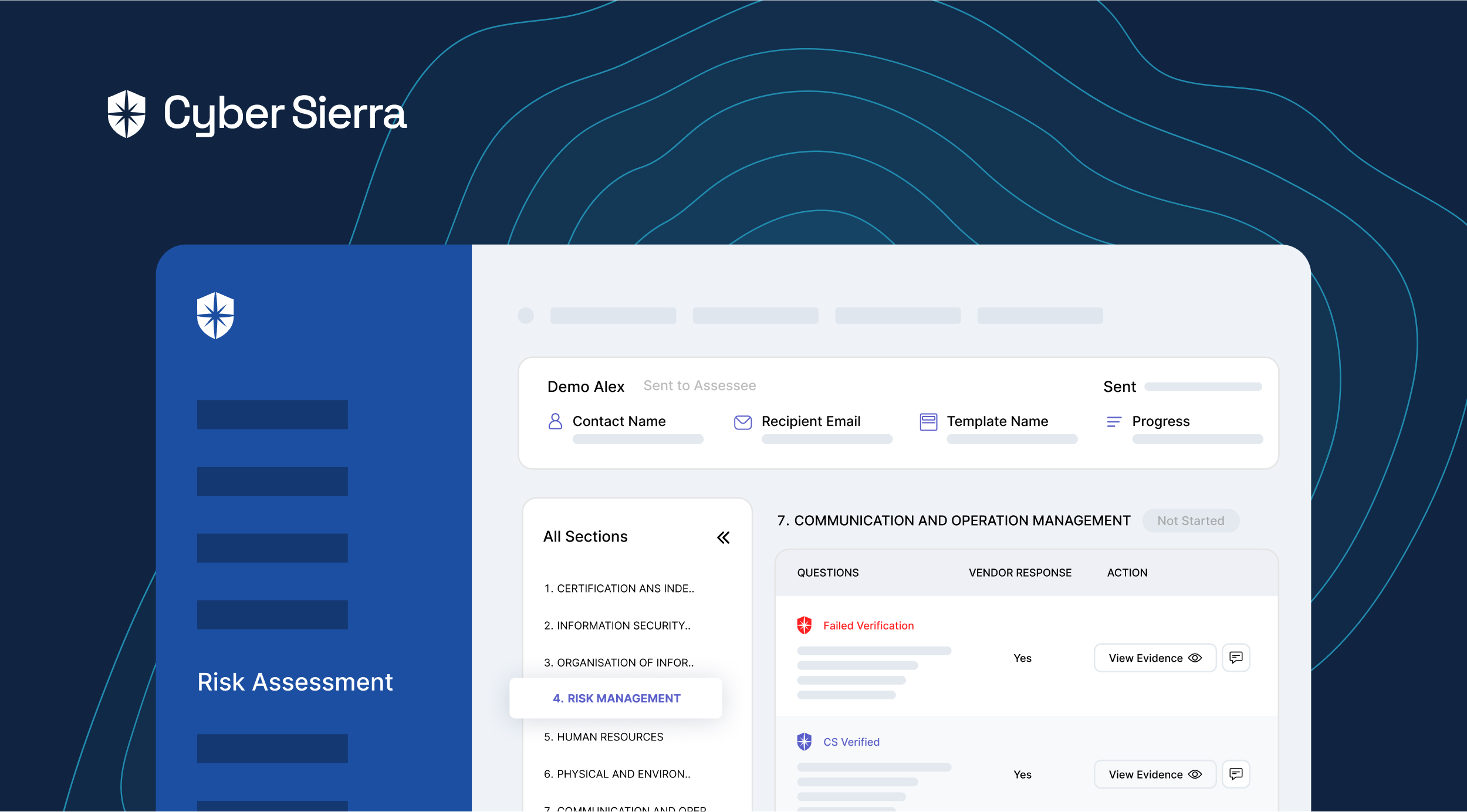

Implementation of ongoing monitoring: Most assessment methods used in TPRM offer a view of a vendor’s risk at a specific moment. This can be limiting. But there are some TPRM platforms, such as Cyber Sierra that allow for near real-time monitoring of the vendors’ security controls

Development of vendor risk management policy: Crafting a Vendor Risk Management (VRM) policy is essential for TPRM. This involves outlining compliance standards responsibilities in the event of a breach, acceptable vendor controls, response protocols, and oversight mechanisms.

Compliance: Ensuring compliance with regulations and industry frameworks is crucial for managing third-party risks. However, staying abreast of the evolving environment can pose challenges. It can get challenging for companies to guarantee that their third-party partnerships adhere to all the relevant regulations.

Integration: TPRM should be an integral part of an organization’s overall risk management strategy. However, companies often struggle to integrate TPRM into their existing business processes, leading to disjointed risk management efforts and potential gaps in risk coverage.

Leverage an Automated Third-party Risk Management program

In general, TPRM is one of the necessary components of a comprehensive risk management program. It helps organizations protect themselves, their customers, and their assets while meeting regulatory compliance, reducing cost, and improving efficiency. Through responsible policies and timely monitoring, organizations can reduce the impact of third-party risks. The right tools enable preparation and forge deals that stimulate growth and success. That said, while you can mitigate third-party risks, it is impossible to eliminate them completely.

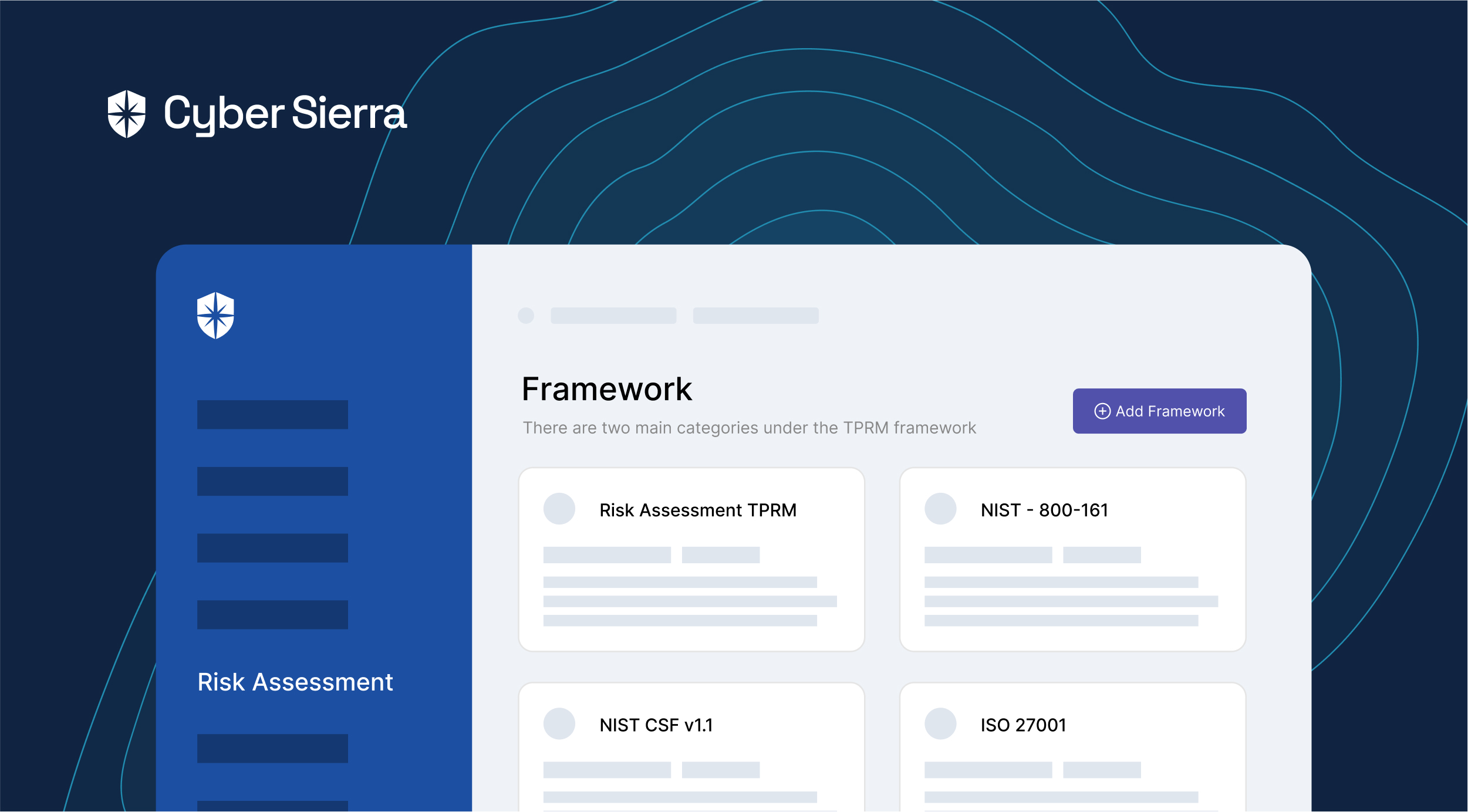

This is where Cybersierra comes in. Our TPRM solution simplifies complex third-party relationships and strengthens an organization’s security posture. It provides a comprehensive view of the third-party ecosystem, identifies and prioritizes risks, and deploys targeted risk mitigation strategies. What’s more, it gives you a dashboard view of your vendor’s security posture at any time, instead of the static, one-time snapshot from traditional security questionnaires.

Schedule a demo now to see how Cybersierra can streamline your TPRM processes. Our platform effectively mitigates third-party risks so you can focus on driving business growth through strategic partnerships.

FAQs

Who falls under the category of a third party?

A third party or vendor can be broadly defined as an external entity with which an organization has entered into a contract or agreement to provide a good, product, or service. This can include suppliers, contractors, service providers, partners, or any other entity outside the organization’s immediate scope that contributes to or impacts its operations.

Why is third-party risk management important?

The importance of third-party risk management (TPRM) lies in safeguarding organizations from cybersecurity threats, supply chain disruptions, and potential data breaches that could lead to reputational damage. It’s not just a matter of best practice; it’s increasingly becoming a regulatory requirement.

Why is continuous monitoring of third-party relationships crucial?

Continuous monitoring of third-party relationships is critical because it allows organizations to identify and address emerging risks in near real-time. It provides ongoing insights into a vendor’s security posture and compliance, ensuring that the organization remains vigilant and proactive in managing potential risks associated with its third-party ecosystem.

A weekly newsletter sharing actionable tips for CTOs & CISOs to secure their software.

Thank you for subscribing!

Please check your email to confirm your email address.

Find out how we can assist you in

completing your compliance journey.