An Ultimate Guide to Regulatory Compliance

Join thousands of professionals and get the latest insight on Compliance & Cybersecurity.

Have you watched the movie Titanic? Of course, you have. What could have changed the dreadful climax of all time? If only the Captain had a proper monitoring system to realize the ship needed more lifeboats and a thorough understanding of the icebergs along the route.

Now, imagine your business as a ship navigating treacherous waters. Regulatory compliance requirements are the map, navigation tools, and safety standards that guide you along the journey, steering you clear of hazards and toward safe harbors. But the waters keep changing, and that’s why this comprehensive guide will provide you with complete awareness of regulatory compliance management and how to ace it like a pro!

What is Regulatory Compliance?

Regulatory compliance refers to an organization’s adherence to the laws, regulations, guidelines, and business practices relevant to its industry and countries of operation. It also includes complying with the organization’s specific procedures, standards, and guidelines.

Regulatory compliance management and regulatory compliance requirements vary significantly depending on the industry, vertical, jurisdiction, and business geography. For organizations with a global footprint, it becomes increasingly important to comply with regulatory compliance requirements across the wide range of geographies they operate. Also, certain industries, such as financial services, information technology, and healthcare, include more complex regulatory risk management. The reason is simple: the impact of these industries on aspects of the economy, business, and infrastructure is significant.

According toNavex Global’s 2023 Definitive Risk & Compliance Benchmark Report, 76% of risk and compliance professionals stated that ensuring their organization builds and maintains an ethical culture of compliance was a very important or absolutely essential consideration in its decision-making processes.

Importance of Regulatory Compliance

Regulatory compliance has become more important than ever, as businesses are now more susceptible to cybersecurity breaches. Moreover, the significance of regulatory compliance is indispensable for the following reasons:

- Upholds the integrity of the business. Everything gets lost when there is no integrity.

- Protects and strengthens stakeholder and public interest.

- Allows the company to operate ethically and fairly and circles back to brand reputation.

- Helps you conquer more clients and business partners. When goodwill and trust increase, it is obvious!

- As a byproduct of the above, the brand perception increases, and so does profitability.

- Helps with steering clear of criminal liability and other major fraudulent crises that can topple not only businesses but even governments. Ask about the subprime mortgage crisis of 2008!

- Helps avoid loss to finance and reputation in case of non-compliance

In a nutshell, be future-ready to manage and mitigate risks when regulatory compliance management is in place.

Challenges in Regulatory Compliance

Adhering to regulatory compliance is not that easy. Going back to the Titanic example, even when the rescue team wanted to help, they faced many challenges. Rose jumped back onto the deck (she was crazy and in love, of course!), passengers grew agitated, clashes broke out, and more. Similarly, regulatory compliance management comes with its own set of obstacles.

Just as the Titanic crew had to navigate tumultuous situations amidst the sinking ship, businesses must steer through turbulent waters to achieve and maintain compliance. Changing regulations, complex requirements, data management issues, and resource constraints can all act as icebergs threatening to derail your compliance efforts.

However, just like the bravery of the Titanic crew inspired hope, a comprehensive plan can guide your organization safely through compliance challenges. With the right map, tools, and expertise, you can chart a course towards fully adhering to all relevant rules and standards governing your industry.

When Regulatory changes keep changing

Regulatory compliance requirements have experienced a surge in recent years, posing significant challenges for compliance teams across various industries and regions. Major regulations worldwide have undergone substantial revisions and upgrades, such as Singapore’s Compliance Code of Practice (CCoP) 2.0, Hong Kong’s Hong Kong Monetary Authority (HKMA) guidelines, the United States’ Federal Trade Commission (FTC) regulations, and Australia’s Comprehensive Income and Risk Management Program (CIRMP).

These evolving regulatory requirements demand continuous adaptation from compliance professionals to stay abreast of the latest standards and requirements. As regulations become more stringent and complex, compliance teams face mounting pressure to maintain comprehensive knowledge and effectively manage their organization’s compliance obligations. Failure to keep pace with these changes can result in substantial risks, including financial penalties, reputational damage, and potential legal consequences.

When finance and technology joined hands

The integration of technology into financial services brings undeniable benefits, but it necessitates increased collaboration between fintech and traditional institutions. This collaboration is essential to address potential overlaps and gaps in regulatory compliance requirements. Regulatory authorities face the challenge of understanding and regulating the combined characteristics of these entities from both financial and technological perspectives. As a result, there’s a growing need for new regulatory guidelines, particularly concerning anti-money laundering (AML) and privacy, to safeguard consumer security.

When cybersecurity and data privacy risks became common

Increasing global footprints and digital transformations have made all of us heavily rely on third-party technologies. There is a rise in cyber-attacks and data privacy issues when there is a third party involved. Third-party risk management is one of the top things to achieve in regulatory compliance management for every regulator. Proper data management and cybersecurity practices are the need of the hour.

Cost of compliance management

Besides the significant fees and penalties of non-compliance, budget constraints are a very important challenge for many businesses when it comes to regulatory compliance. While the costs associated with compliance are undeniable, it’s crucial to recognize that a strategic, enterprise-wide approach can not only mitigate these expenses but also unlock long-term benefits.

Building a proactive compliance culture

Establishing a strong culture of compliance is crucial for promoting good employee conduct, especially with the rise of remote and hybrid work models after the pandemic. Amidst these changes, the growing importance of culture and conduct risks highlights the need for compliance teams to encourage proactive reporting. However, achieving this goal presents numerous challenges. From effectively communicating regulatory updates to instilling a sense of caution regarding compliance management risks, compliance teams face the difficult task of ensuring that every employee is well-informed and engaged. Overcoming these obstacles and emphasizing the significance of regulatory compliance across the organization emerges as a formidable challenge for compliance teams.

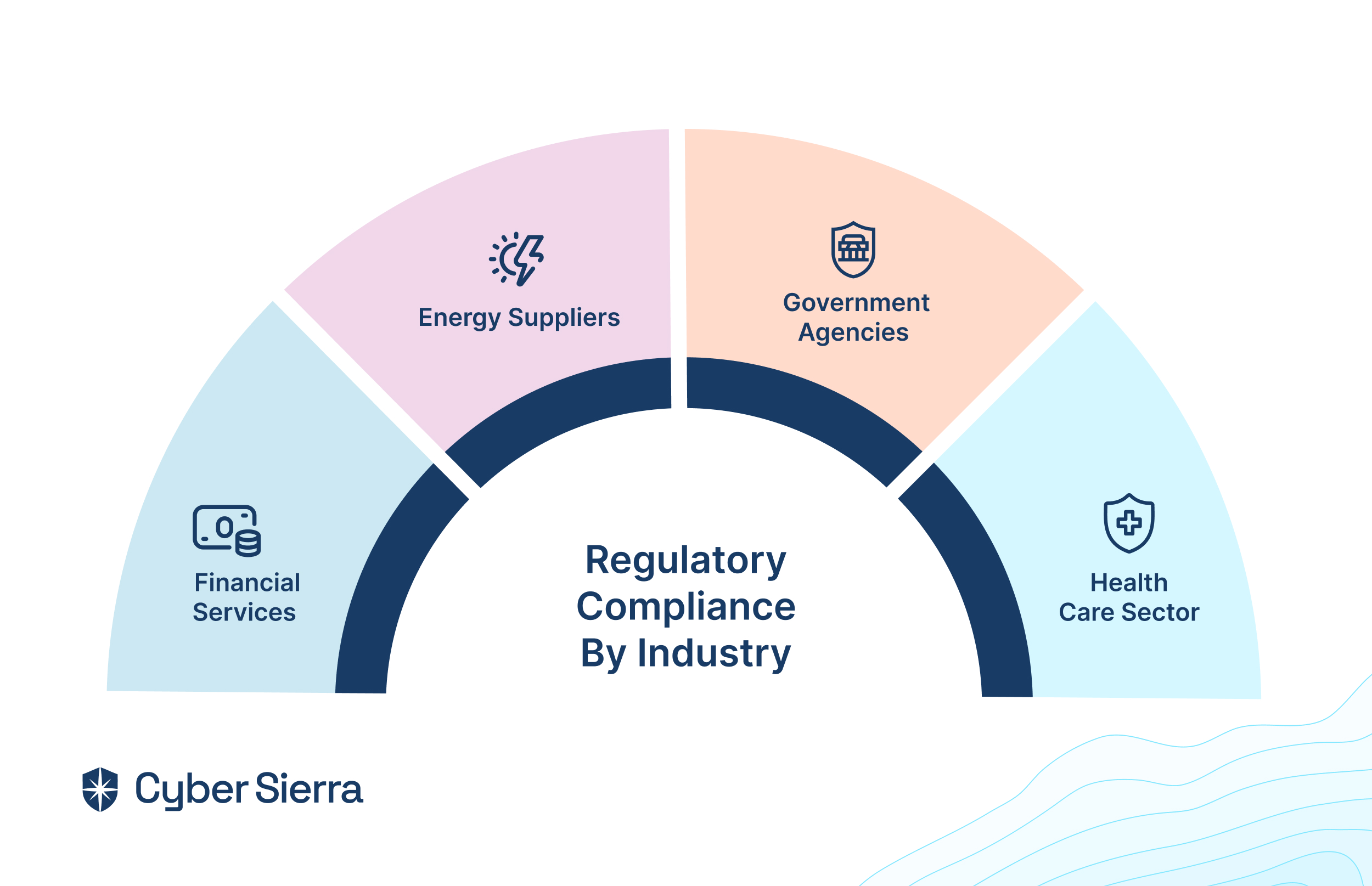

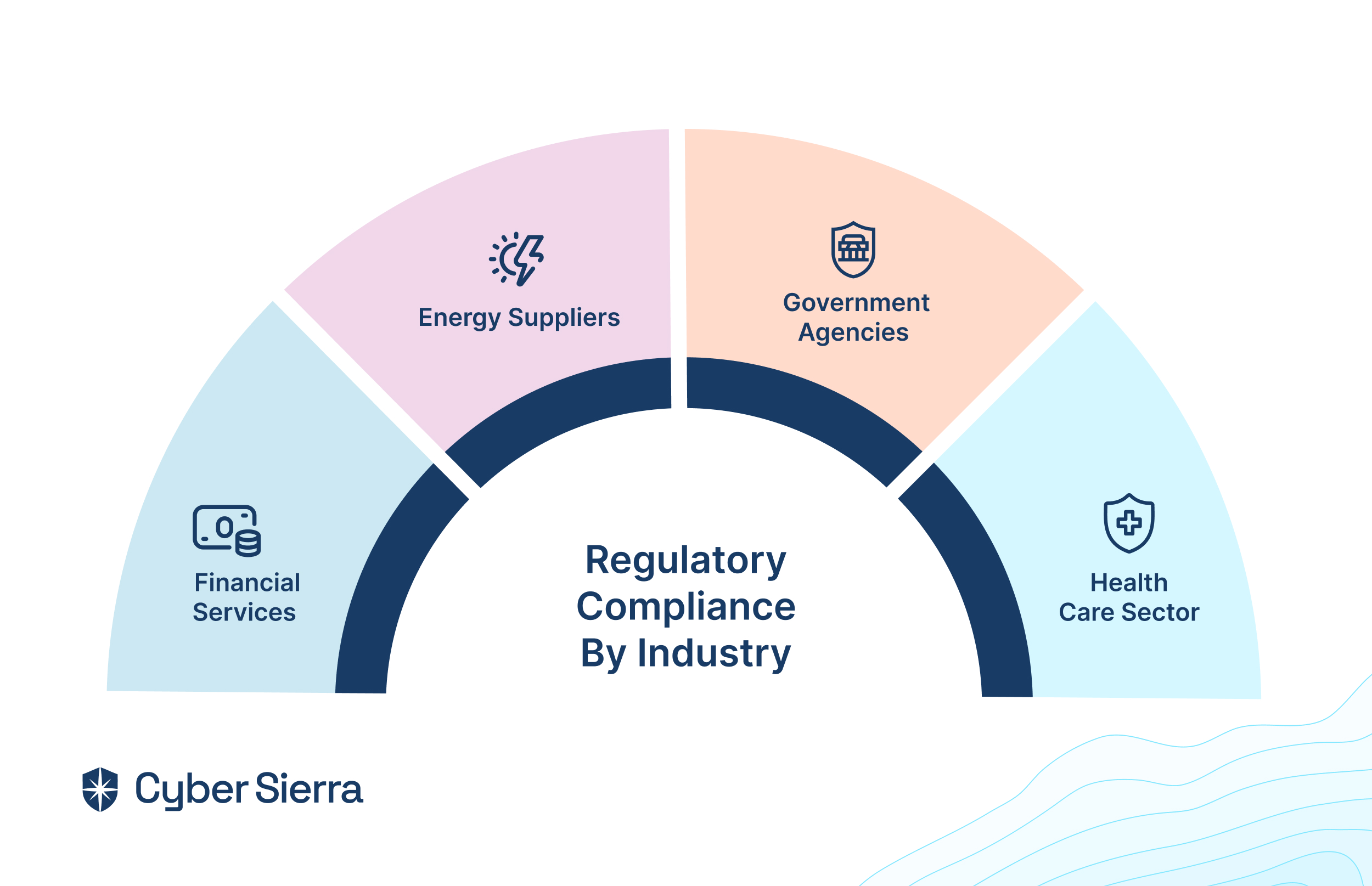

Regulatory Compliance by Industry

The nature of regulatory compliance management and regulatory compliance requirements vary depending on different industries. Certain industries require heavy regulations compared to others.

Regulatory compliance for financial services

The financial services industry demands a tailored approach to compliance management due to the comprehensive and complex nature of regulations it is subject to. These regulations are designed to uphold stability, transparency, and consumer protection within the sector.

Regulatory bodies such as the Securities and Exchange Commission (SEC) , the Federal Reserve in the US, the Federal Information Security Management Act (FISMA), and the Financial Conduct Authority (FCA) across geographies, oversee compliance.

Regulatory compliance requirements mandate anti-money laundering (AML) regulations, know-your-customer (KYC) requirements, data security standards, including Payment Card Industry Data Security Standard – PCI DSS), and other financial reporting, regulatory standards such as Generally Accepted Accounting Principles – GAAP).

Furthermore, specific jurisdictions like Singapore (Monetary Authority of Singapore – MAS), India (Reserve Bank of India – RBI, Securities and Exchange Board of India – SEBI), Australia (Australian Prudential Regulation Authority – APRA, Australian Securities and Investments Commission – ASIC), and Hong Kong (Securities and Futures Commission – SFC, Hong Kong Monetary Authority – HKMA) have their own unique regulatory frameworks governing the financial services industry.

- Singapore: MAS regulates financial stability, AML/CFT, and cybersecurity.

- India: RBI and SEBI enforce prudential norms, risk management, and securities laws.

- Australia: APRA ensures financial stability, while ASIC focuses on consumer and investor protection.

- Hong Kong: SFC and HKMA overseas market integrity, AML, KYC, and data privacy.

Regulatory compliance for energy suppliers

Regulatory compliance in the energy suppliers industry mandates regulations for safety and environmental protection. Regulatory risk management for this industry aims to ensure safety, environmental protection, and efficient operations. These include compliance requirements related to environmental regulations (e.g., emissions standards, waste management), safety standards (e.g., Occupational Safety and Health Administration – OSHA in the US), and industry-specific regulations governing energy production, distribution, and pricing.

Regulatory compliance for government agencies

Government agencies are subjected to strict compliance regulations. This mandate helps in achieving equality for everyone and encourages ethical staff behavior. Compliance management for the government sector includes federal, state/provincial, and local laws, as well as regulations specific to the agency’s mandate. These can be budgetary regulations, procurement laws, and administrative procedures acts. Ethical standards are indispensable, and regulatory complaint requirements here foster avoiding conflicts of interest, maintaining transparency and accountability, and adhering to codes of conduct and ethics guidelines.

Since government agencies deal with sensitive information, such as citizen data, financial records, and classified materials, compliance with data security and privacy regulations is crucial to protect this information from unauthorized access, disclosure, or misuse. For example, in the United States, you are expected to comply with laws such as the Privacy Act, in the European Union, you are expected to comply with the General Data Protection Regulation (GDPR).

They are also required to ensure accessibility and non-discrimination in the delivery of their services and programs. This includes compliance with laws such as the Americans with Disabilities Act (ADA) in the United States, which mandates accessibility accommodations for individuals with disabilities.

Regulatory compliance for the healthcare sector

Healthcare companies require strict compliance laws. This is obvious as they store a lot of sensitive and personal patient data. Hospitals and other healthcare providers are built majorly on trust and reputation. This requires them to exhibit the necessary steps that they have taken to comply with certain regulations, such as patient privacy rules, including providing adequate server security and encryption.

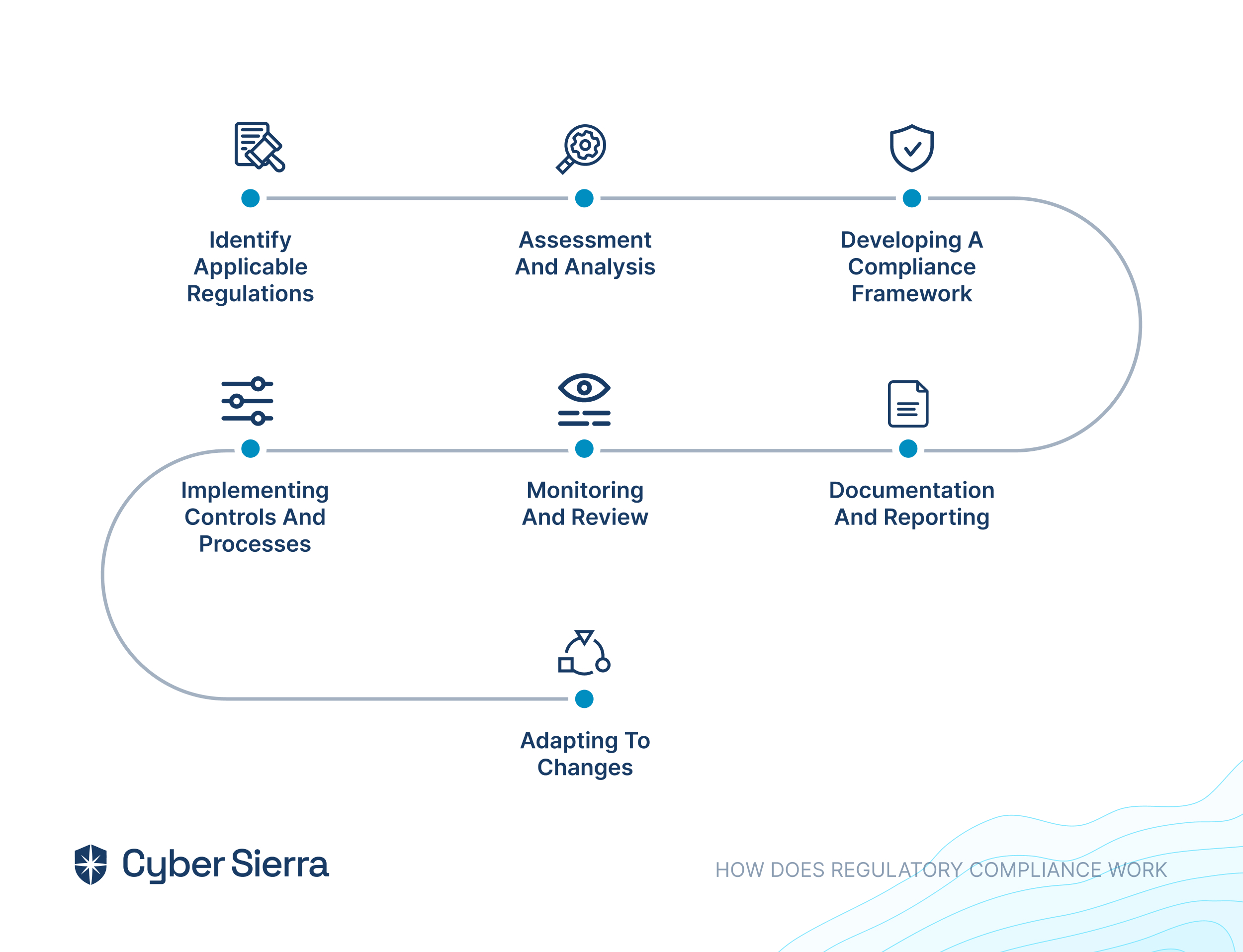

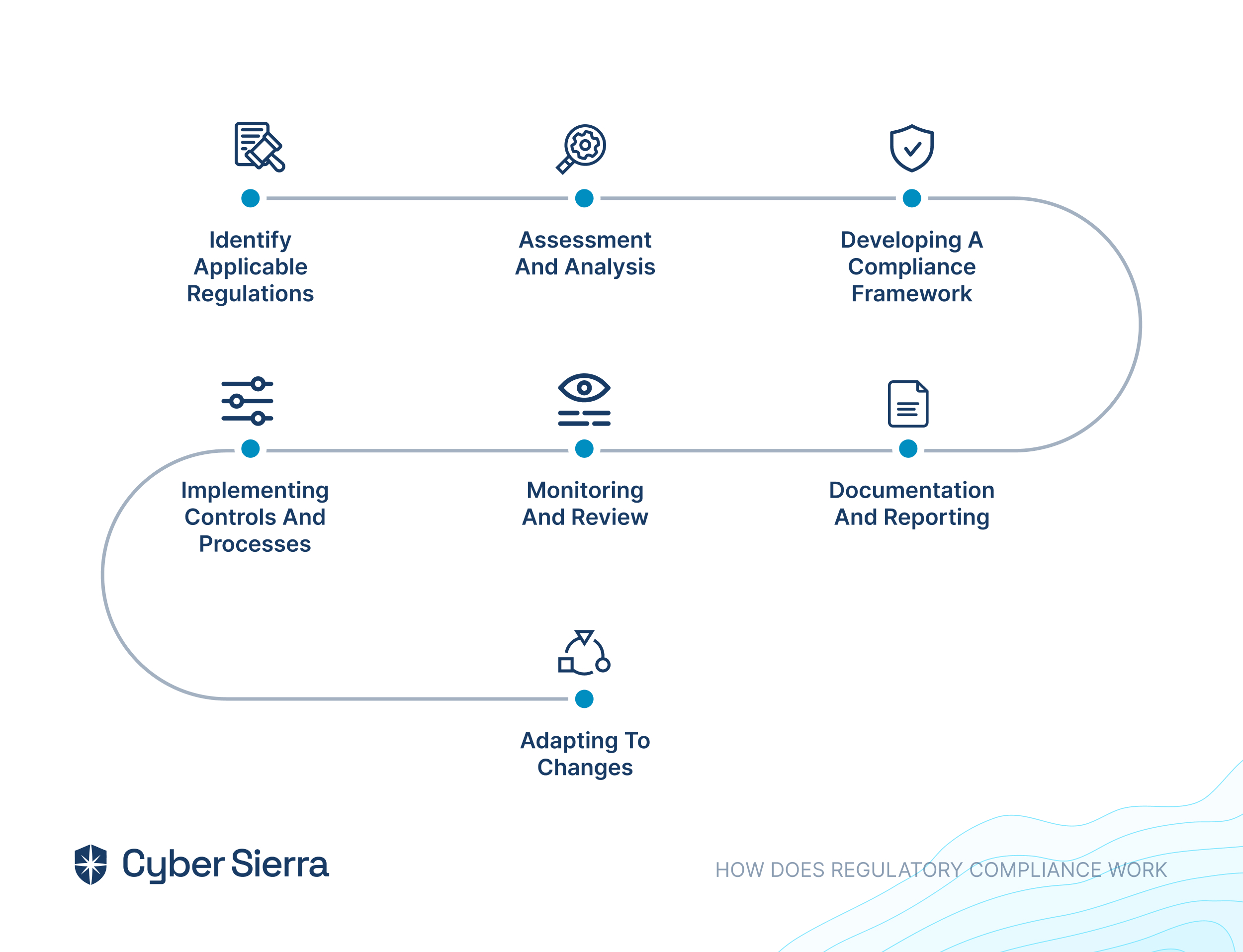

How Does Regulatory Compliance Work?

Regulatory compliance works as a systematic process. It enables organizations to adhere to relevant laws, regulations, standards, and guidelines that govern its operations. Here’s an overview of the process it entails:

Identify applicable regulations:

The organization first identifies the necessary regulations, laws, and standards relevant to its industry, jurisdiction, and activities. This process requires thorough research and understanding of the regulatory landscape.

Assessment and analysis:

Now that the applicable regulations are identified, it’s time to conduct a comprehensive assessment to understand the specific regulatory compliance requirements and implications for its business operations. This is usually done by analyzing the regulatory provisions, assessing current practices, and identifying any areas of non-compliance.

Developing a compliance framework:

The assessment is done and the findings are ready; now the organization develops a compliance framework that clearly outlines compliance management policies, procedures, controls, and measures that will ensure adherence to regulatory compliance requirements. Now, the roadmap for achieving and maintaining compliance is ready.

Implementing controls and processes:

Kudos! The compliance framework is in place now, and the organization implements the necessary controls, processes, and systems to operationalize the outlined compliance requirements. This is usually executed by establishing protocols for data protection, implementing safety procedures, conducting employee training, and integrating compliance into everyday business operations.

Monitoring and review:

One thing that needs to be understood is that compliance is an ongoing process. It requires continuous monitoring and constant review to ensure that the controls are effective, that the regulations are being followed, and tracking any changes in requirements are promptly addressed.

Documentation and reporting:

Every organization should maintain detailed documentation of its compliance efforts, including policies, procedures, records, and reports. Regulatory compliance documentation not only serves as evidence of adherence to regulatory requirements but will also be required for regulatory inspections, audits, and reporting obligations.

Adapting to changes:

Regulatory requirements will keep changing due to new legislation, updates, and evolving industry standards. Here, the organization stays informed about changes in regulations relevant to its operations and immediately adapts its compliance efforts accordingly.

How to Implement a Regulatory Compliance Plan?

Congratulations! You’ve made the wise decision to establish a robust regulatory compliance plan for your organization. Navigating the complex landscape of industry regulations can be daunting, but fear not – Cyber Sierra’s proven 8-step framework will guide you through the process, ensuring an effective and rewarding implementation.

-

What are your goals?

The first step is simply to simply define your goals. Ask yourself what you wish to achieve with your regulatory compliance management plan. The goals can be diverse – you might want to cut down the hefty fines, penalties, and payouts of the company, save time and expense based on retrospective investigations, or work with everyone in the team to use complaints to increase growth or it could be even as simple as getting awareness on a new piece of incoming legislation that might affect your organization in the future.

Begin by clearly defining your objectives for the regulatory compliance management plan. Whether it’s reducing financial liabilities, saving time on retrospective investigations, fostering team collaboration for growth, or staying ahead of upcoming legislation, establishing clear goals is essential. Sit down with your team to map out a risk assessment and prioritize goals for the short and long term, setting achievable targets to work towards. It’s crucial to set specific, measurable, achievable, relevant, and time-bound (SMART) targets to track progress effectively.

For example, if you head the operations of an international bank, the primary goal is to strengthen its regulatory compliance program to mitigate the risk of money laundering activities and ensure adherence to AML regulations. By implementing stricter compliance measures, you can aim to enhance your reputation, safeguard your assets, and maintain the trust of your customers and regulators.

-

What is your corporate culture?

Understand and draft what corporate culture your business falls into. When this is done, it is easier to align compliance with corporate culture. Aligning regulatory compliance with corporate culture makes it easier for everyone in the company to bring acceptance of your new policies. Ensure you outline the advantages of regulatory compliance management at each level of the company’s structure, and it will come a long way in making your employees understand its importance more clearly.

Identify and define the risks that compliance can help you avoid in each strategic area of the organization to build a strong case for your policy. Everyone in the company must be aware of your regulatory compliance management. Or your risk management efforts will turn out to be ineffective. For example, understand your bank’s corporate culture of integrity and transparency and encourage the compliance team to integrate AML compliance training into the organization’s values and mission. By emphasizing the importance of ethical conduct and regulatory adherence, you can foster a culture of compliance where every employee understands their role in preventing financial crimes.

-

What is your functional scope?

The scope of regulatory risk management is no longer a retrospective role. But it is more forward-facing and it only acts as a preventative function in the organization. If you want to foresee regulatory issues before they occur, you have to increase resources, and your compliance management plan needs to reflect that. Start at a basic level and gradually increase the scope over time.

Consider incorporating technologies like robotic process automation (RPA) and artificial intelligence (AI) to enhance efficiency and accuracy. Start with a foundational level of compliance and gradually expand the scope over time as resources allow. For example, by recognizing the proactive nature of regulatory risk management, you can allocate resources to enhance your AML compliance capabilities. Starting with basic transaction monitoring systems, you can gradually expand the scope to include advanced analytics and machine learning algorithms to detect suspicious activities and prevent potential money laundering risks.

-

What is the nature of your regulatory environment?

As discussed in the challenges already, the regulatory environment is always changing. This makes it essential for your team to stay on top of regulatory compliance trends at all times. Monitor legislative developments not only in your primary operating region but also in any other jurisdictions where your business operates. Thoroughly analyze proposed regulations to anticipate their impact on your operations. Break down regulatory requirements into actionable steps to ensure full compliance.

For example, your bank’s compliance team can stay vigilant in monitoring regulatory developments related to AML regulations globally. They can analyze updates to the Bank Secrecy Act (BSA) and Financial Action Task Force (FATF) recommendations to ensure CityBank’s compliance procedures remain up-to-date and align with evolving regulatory standards.

-

How to develop formal procedures, rules, and standards?

Now, you have a clear understanding of the prospective regulatory landscape. It’s time to develop the formal policies, standards, and procedures required to comply with the law. Though most of these procedures will closely follow the technical standards outlined in the legislation, you should also consider adding your own internal checks. This helps in identifying potential human or software errors and avoiding consequences.

For example, with a clear understanding of AML regulatory requirements, you can develop formal policies and procedures tailored to detect and prevent money laundering activities effectively. Collaborating with industry experts and regulatory authorities, you can establish robust customer due diligence processes and transaction monitoring protocols to comply with AML laws.

-

Have you trained your employees?

All your efforts will become null if your employees are not trained. Thorough training about your procedures is important, and making them understand the reasons behind them is mandatory to make sure that the business remains compliant. Train your employees to spot a compliance issue, report it accurately, and escalate it through the right means. At the next level, your management should be well-equipped to handle reports and take swift calls on what to do next, as well as how their operations with business partners are affected.

For example, you can conduct comprehensive AML compliance training programs for all employees, ranging from frontline staff to senior management. Through interactive workshops and scenario-based simulations, employees learn to identify red flags indicative of money laundering activities and understand the importance of reporting suspicious transactions promptly.

-

Do you practice accurate record-keeping?

Accurate record-keeping is crucial for demonstrating compliance with regulatory requirements and facilitating audits or investigations. Establish clear guidelines for documenting compliance-related activities and maintaining records securely. Regularly review and update record-keeping practices to adapt to changing regulatory landscapes.

For example, you can implement electronic record-keeping systems to maintain detailed transaction records and customer profiles, ensuring accurate documentation of AML compliance efforts and enabling timely reporting to regulatory authorities.

-

Do you monitor compliance consistently?

Continuously monitor and evaluate compliance performance to identify areas for improvement and ensure ongoing adherence to regulatory standards. Utilize analytics tools and metrics to track progress toward goals and measure the effectiveness of compliance initiatives. Regularly report findings to senior leadership to demonstrate the value of compliance efforts and secure support for future initiatives. You can use a digital tool such as CyberSierra to keep a central control repository, identify third-party risks, and automate data collection and risk assessment.

For example, you can continuously monitor your AML compliance performance using data analytics tools and risk assessment frameworks. By tracking key performance indicators such as transaction monitoring alerts and suspicious activity reports, you can assess the effectiveness of its AML controls and identify areas for improvement to strengthen your compliance program further.

Keeping a regular check on your goals on a quarterly or annual basis will help in evaluating your support compliance efforts. Present the results to your senior leadership and explain the benefits of an effective program. This motivates decision-makers to justify the efforts and investment in corporate regulatory compliance.

How does Cyber Sierra help you with regulatory compliance management?

Cyber Sierra understands business challenges and offers a comprehensive solution to simplify data collection, risk assessments, and compliance management. Our cutting-edge AI platform streamlines the entire process, making it effortless to gather, analyze, and interpret data, enabling you to identify and mitigate risks proactively.

Cyber Sierra automates data collection & risk assessments, helps with policies management, generates comprehensive reports and maintains detailed records for transparency and accountability. The platform also streamline compliance management across various regulatory frameworks using automation

Don’t let compliance complexities sink your operations. Take a proactive approach and experience the best regulatory compliance management for your business. Schedule a demo with Cyber Sierra today and unlock the power of automated, streamlined, and efficient compliance management.

FAQs

What is regulatory compliance management?

Regulatory compliance management, in simple terms, is a company’s adherence to laws, regulations, guidelines, procedures, rules, and other necessary specifications relevant to its business processes, industry and country of operation. Not adhering to regulatory compliance results in legal punishment, including hefty federal penalties.

Is regulatory compliance management important?

Regulatory compliance management is very important. It goes beyond merely adhering to legal requirements; it serves as a cornerstone for establishing a credible brand reputation, fostering trust with partners, customers, and stakeholders, and safeguarding the organization from potential breaches. Non-compliance can have severe consequences, including financial penalties, reputational damage, loss of consumer confidence, and even the potential termination of business operations.

How can regulatory compliance management benefit your organization?

Regulatory compliance benefits businesses by identifying and mitigating risks associated with legal and regulatory obligations. A robust compliance framework, encompassing comprehensive processes and stringent security controls, equips organizations to proactively mitigate and circumvent non-compliance incidents, such as data breaches, workplace accidents, or environmental contraventions. Adherence to regulatory mandates not only safeguards organizations from substantial financial penalties but also fortifies their brand reputation and credibility within the industry.

How often should you create a compliance management plan?

The frequency of creating a compliance management plan varies based on factors like industry standards, regulatory requirements, and organizational needs. While there’s no fixed rule, it’s generally recommended to review and update the plan at least annually. This ensures that it remains aligned with evolving regulations, business changes, and emerging risks, helping to maintain compliance effectiveness and mitigate potential issues.

Can we use automation for compliance management?

Yes, you can use compliance automation technology, such as Cyber Sierra, to continually check your systems for compliance. Compliance automation helps automate workflows and removes manual processes. For example, Cyber Sierra’s smart GRC automation helps in streamlining Governance, Risk, and Compliance (GRC) processes, saving time and effort in data collection, analyses, and reporting.

A weekly newsletter sharing actionable tips for CTOs & CISOs to secure their software.

Thank you for subscribing!

Please check your email to confirm your email address.

Find out how we can assist you in

completing your compliance journey.